Digital was the focus for many Children’s publishers attending this year’s LBF, and we saw a significant increase in the number of walk-ups enquiring about the Children’s eBook market with questions primarily around the size of the market, channels, formats and devices. With the explosion of tablet computers and other robust mobile devices on the market such as the iPad, Barnes and Noble Nook and Amazon Kindle Fire, the demand for high quality graphical content is higher than ever, especially for Children’s books.

Recent sales figures show that the value of children’s eBooks fell last year, primarily due to unfavourable comparisons because of the success of 2012’s The Hunger Games series. Children’s eBooks generated $170.5 million in US sales in 2013, a sizable market and about 11% of the total Children’s book market according to the AAP. Still, children’s ebook sales were up considerably from 2011, when they were about $105 million. It will be interesting to see what 2014 holds for this segment of the market, as more publishers engage and learn how to drive markets and revenue.

One Children's publisher at the forefront of the digital revolution is Usborne Publishing. Having just come on board with Vearsa, Usborne Publishing have well and truly embraced the online revolution. One example of this is through creating around 200 titles with embedded internet links to over 100,000 websites giving further topic-based information (www.usborne-quicklinks.com). Recent winners of the Independent Publisher of the Year and Independent Children’s Publisher of the Year awards in February 2014, Usborne are the biggest independent children’s book publisher in the UK and have really embraced the power of digital including many new innovations to build and develop new readers and revenues. As we deep dive into the marketplace with Usborne we are learning lots about the specific marketplace, its challenges and its opportunities.

From a marketing perspective, the internet and technology is opening up opportunities for children’s publishers in ways that they could only have dreamed of a decade ago. Book brands like Beast Quest (Orchard), Young Bond (RH) and Authur Quinn (Mercier Press) all now have their own dedicated web space with activities, features to download and online fan clubs. Publishers have probably always viewed major children’s brands as ‘stand-alone’ identities, and are busy developing specific websites to engage with their target market – children expect to find this information online.

With all this in mind, I spent some time going through our sales data for all our Children’s titles and found some interesting pieces of data I thought I’d share with you. I looked at the two broad BISAC’s:

Key Points:

--Fiction performs 10x better than non-fiction

--Non-fiction is steadier, with Fiction seeing a lot more ‘ups and downs’

--Non-fiction sees a better geographic spread of sales, with Fiction sales very UK centric (probably a reflection of rights)

--Amazon is leading the sales charge in both but;

--Kobo are the next largest, followed by Apple (Kobo’s sales are just over twice Apples)

--Other channels with significant sales are libraries, Nook, Libri, Oyster and Txtr.

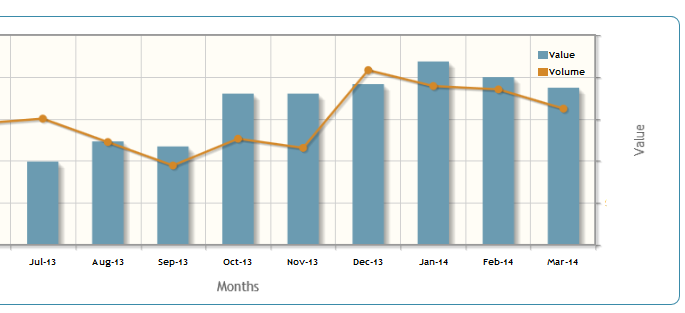

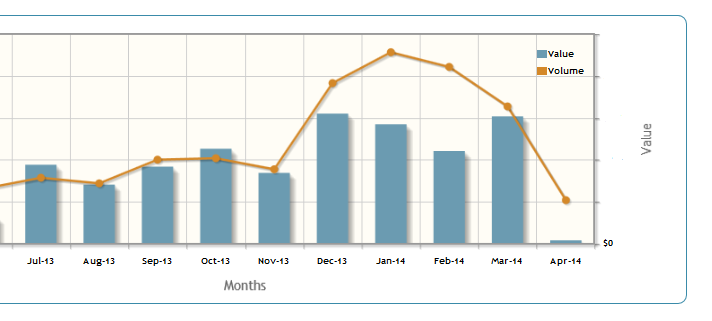

Here are two screenshots from our system, one for each BISAC level. Each screenshot shows Value and Volume over the past year.

Juvenile Non-Fiction: General

Juvenile Fiction: General (April sales aren’t in from retailers yet)

If you have any questions on eBooks for the Children's market - please get in touch.

You'll hear from us!